Coles B2B EDI Compliance

1. Coles EDI requirements

1.1 Documents

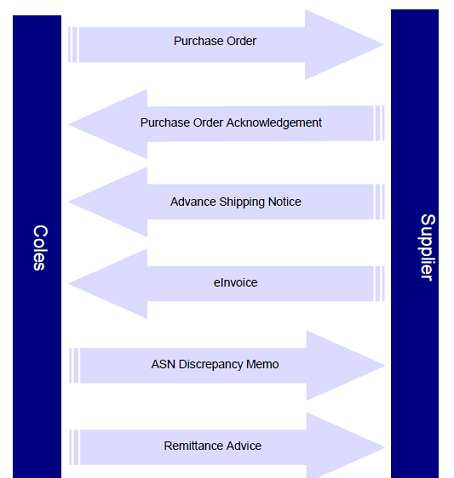

Coles EDI implementation requires below business documents electronically transmitted. Mandatory documents are as below.

- Purchase Order (Coles => Supplier's EASYB2B account)

- Purchase Order Acknowledgement/Response (Supplier's EASYB2B account => Coles)

- Shipment Notice (Supplier's EASYB2B account => Coles)

- Tax Invoice (Supplier's EASYB2B account => Coles)

(Reference: https://www.supplierportal.coles.com.au/csp/wps/portal/web/ElectronicTrading/ImplementingB2B )

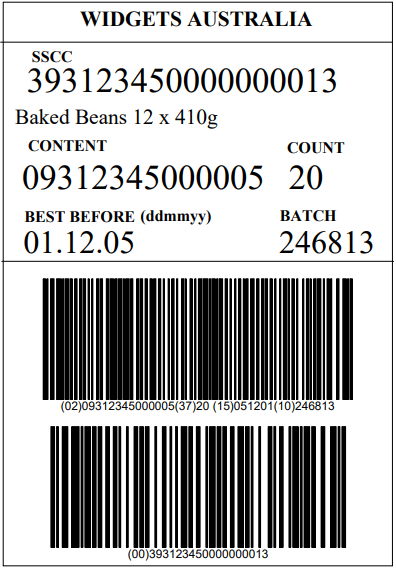

1.2 Shipping Labels

Additionally, Coles requires every logistic unit of the goods, generally a pallet, to be labelled with Coles specific barcode (technically known as SSCC - Serial Shipping Container Code, generally known as Shipping Labels).

2. Solutions

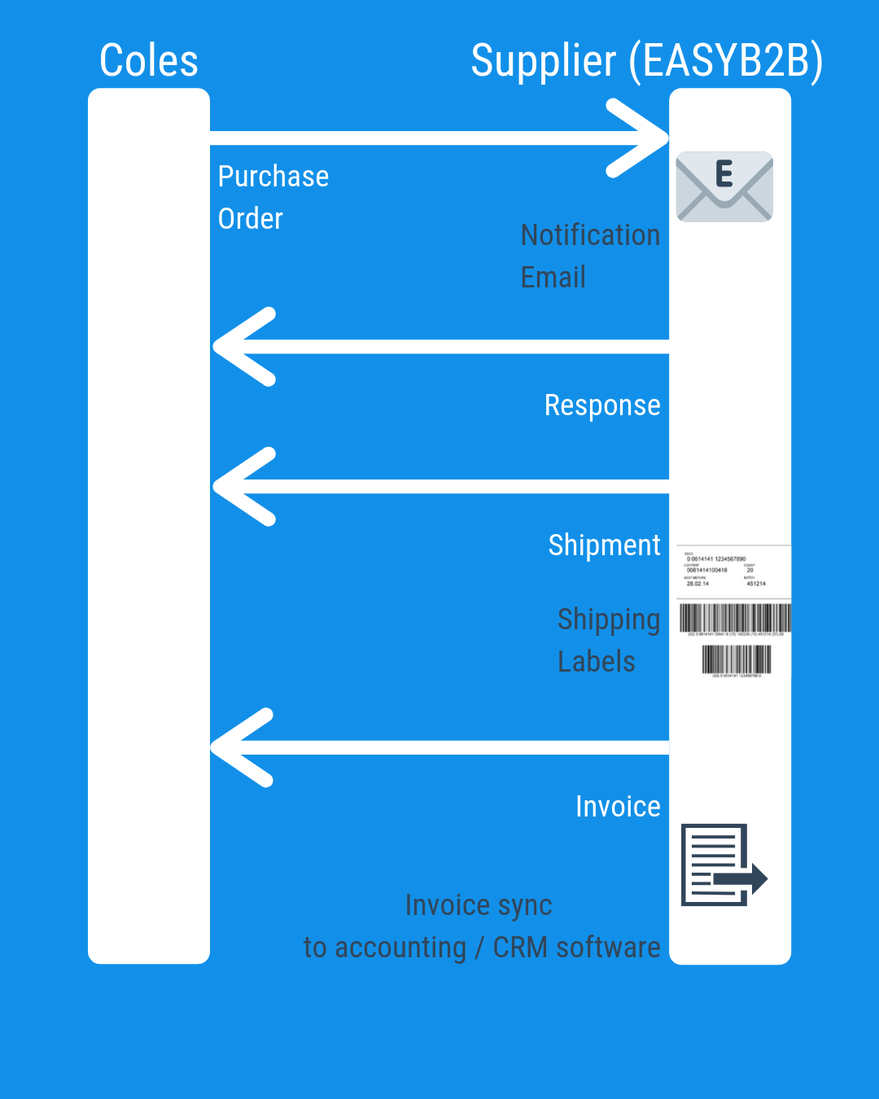

2.1 Small business with no 3PL integration

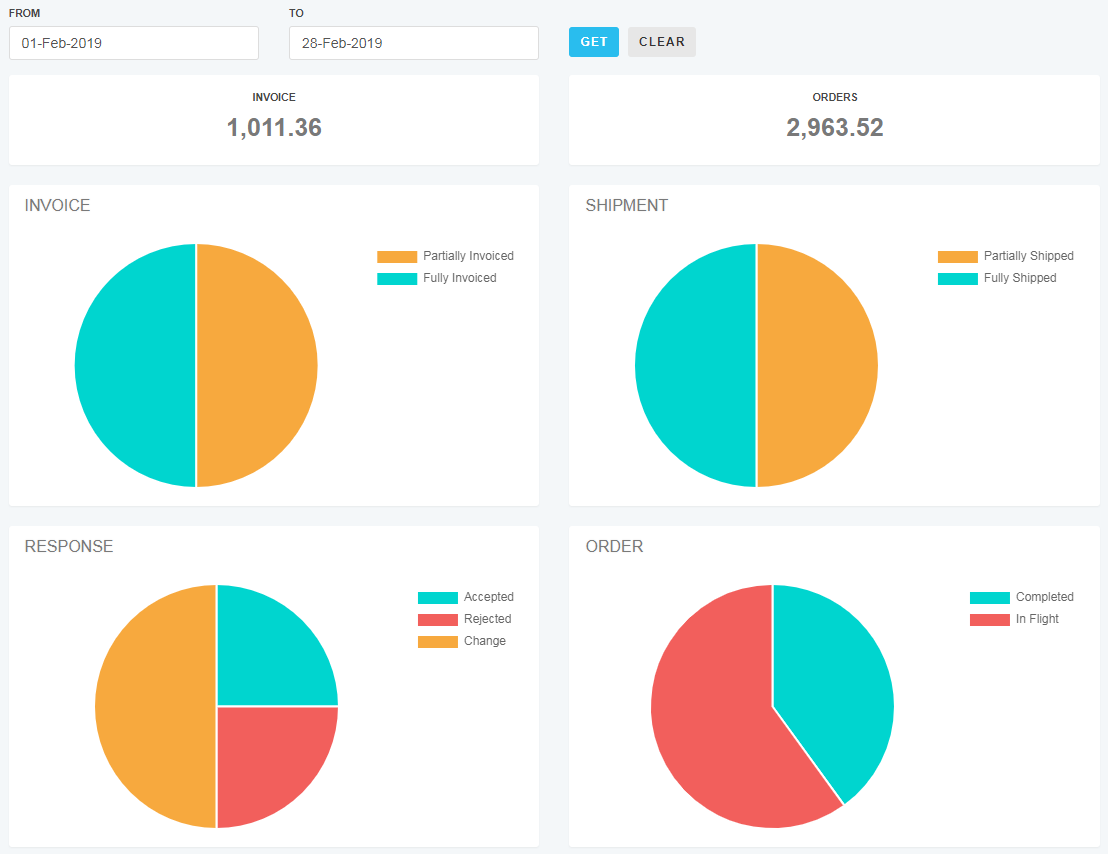

Includes Invoice sync to supplier’s accounting / CRM software

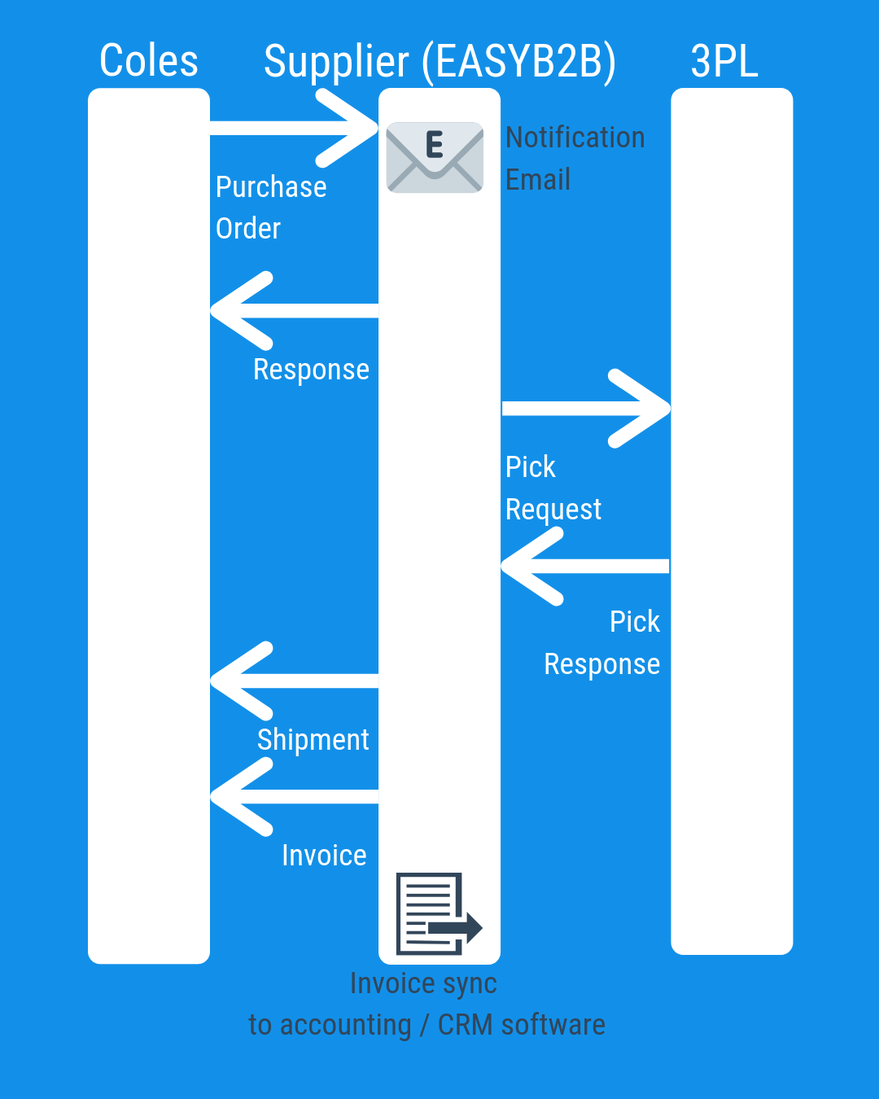

2.2 Small to medium business with 3PL integration

Includes Invoice sync to supplier’s accounting / CRM software

3. Help me decide

3PL is an organization's use of third-party businesses to outsource elements of its distribution, warehousing, and fulfillment services.

- If you do not use 3PL => Small supplier with no 3PL integration.

- If you use 3PL only for freight => Both implementation works, however with 3PL integration, manual sharing of Pick List to 3PL becomes redundant and no need to create Shipment Notice manually.

- If you use 3PL for warehousing, packaging, distribution and fulfillment service => Small to medium supplier with 3PL integration.

- If your 3PL manages the Shipping Labels on logistic units (mostly a pallets) on your behalf => Small to medium supplier with 3PL integration.

4. Next? No obligation EASYB2B account

We understand every business. For your no-obligation EASYB2B account to experience the product, please contact us @ hello@easyb2b.com